7 Nigerian Startups Backed by Y Combinator Proving Global Tech Can Be Built from Africa

Seven of the sixty YC backed Nigerian startups, as highlighted by YC.

For a long time, the idea of building globally competitive technology companies from Africa was treated as an exception rather than a pattern. Capital was scarce, networks were limited, and global investors often viewed African markets as risky or niche.

That narrative is changing, and one of the strongest signals of that shift is Y Combinator.

Founded in March 2005, Y Combinator is one of the most influential startup accelerators in the world. It has backed companies like Airbnb, Stripe, Dropbox, and Coinbase. Over the years, YC has increasingly opened its doors to founders outside Silicon Valley, including a growing number from Nigeria.

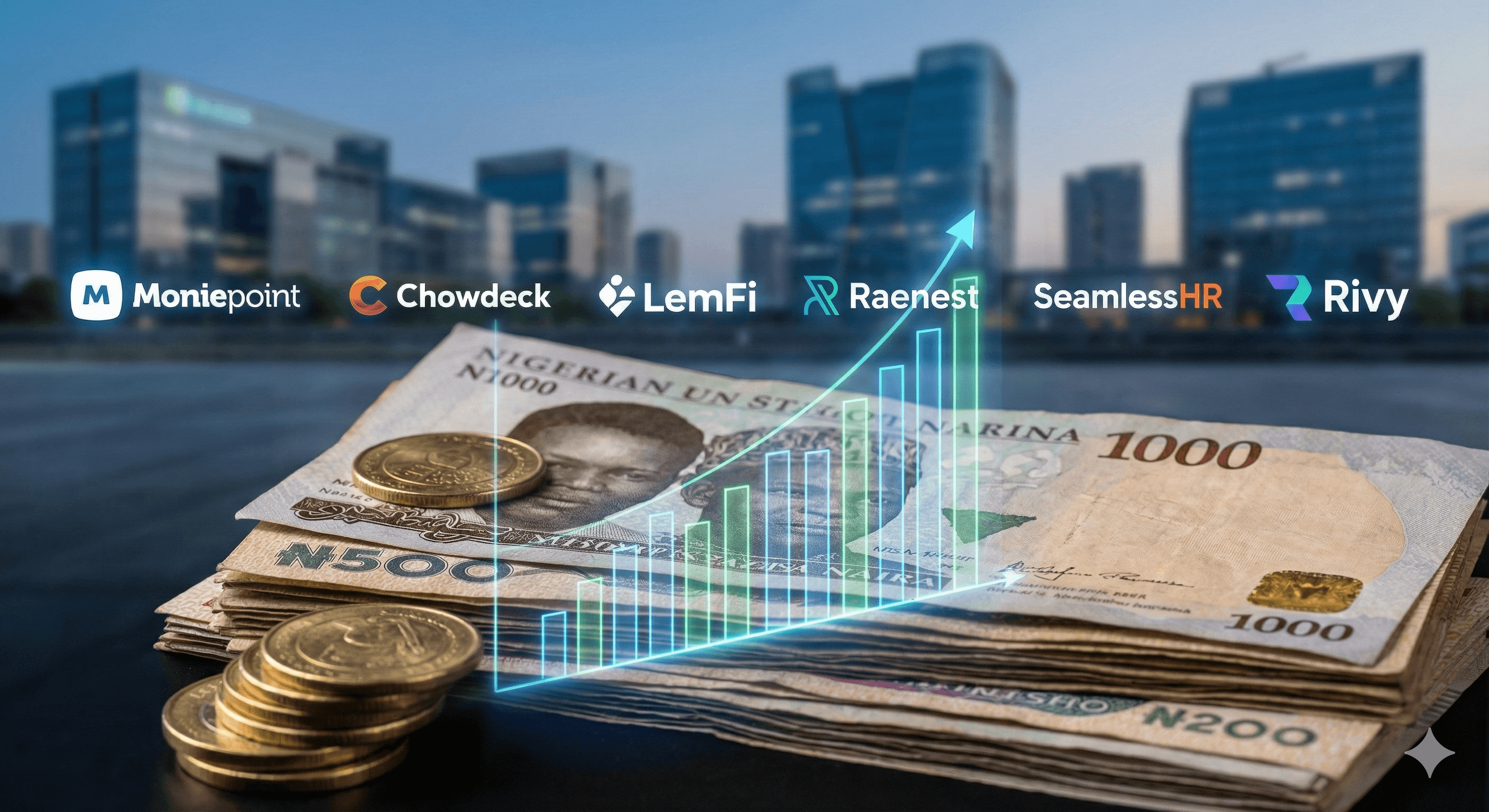

Today, Nigerian founders are not just participating in Y Combinator. They are building category-defining companies across fintech, healthtech, agriculture, logistics, and consumer services. Collectively, these companies have raised hundreds of millions of dollars and serve millions of users globally.

So far, YC has backed 60 startups from Nigeria.

This article takes a closer look at seven of those Nigerian startups backed by Y Combinator, what they do, and why their success matters for Africa’s tech ecosystem.

The rise of Nigerian founders in Y Combinator

Nigeria has become the beating heart of Africa’s startup ecosystem. With a population of over 220 million people, a fast-growing internet economy, and a young, technically skilled workforce, the country presents a unique opportunity for technology-driven solutions.

Y Combinator’s backing of Nigerian startups is not charity or experimentation. It is a calculated bet on founders who understand local problems deeply and can build scalable products with global relevance.

The startups below reflect that trend.

- Transforming agriculture through finance and data

ThriveAgric is an agritech company focused on empowering smallholder farmers across Nigeria and other parts of Africa. The company provides farmers with access to financing, quality inputs, data-driven advisory services, and reliable market connections.

Agriculture employs millions of Africans, yet access to capital and modern farming tools remains limited. ThriveAgric addresses this gap by using technology to reduce risk, improve yields, and increase farmer incomes.

The company was accepted into Y Combinator’s Winter 2019 batch. Since then, it has grown into one of Africa’s most recognised agritech startups, facilitating agricultural financing at scale and contributing to food security efforts.

ThriveAgric’s success demonstrates that African startups can solve foundational economic problems while building sustainable businesses.

LemFi

- Building global financial services for immigrants

LemFi is a fintech company designed for immigrants and diaspora communities. It provides multi-currency digital accounts and low-cost international money transfers, enabling users to send and receive money across borders with ease.

The company joined Y Combinator’s Summer 2021 cohort and has since experienced rapid growth. LemFi has raised significant funding, bringing its total capital to approximately $85 million. It processes billions of dollars in transactions and serves users across North America, Europe, and Africa.

Remittances play a critical role in African economies. LemFi’s platform reduces transfer costs and improves access to financial services for millions of people who rely on cross-border payments.

This is a clear example of a Nigerian-founded startup building for a global audience from day one.

Credpal

Expanding access to credit through ‘buy now pay later’

CredPal operates in the buy now pay later space, offering consumers flexible payment options that allow them to spread the cost of purchases over time. In markets where traditional credit is difficult to access, this model opens doors for more consumers to participate in digital commerce.

CredPal is part of Y Combinator’s broader alumni network and has become a recognised player in Africa’s consumer finance ecosystem. By focusing on responsible credit access, the company supports both merchants and customers while driving economic activity.

As digital payments and online shopping grow across Africa, platforms like CredPal play a crucial role in shaping consumer behaviour and financial inclusion.

Nomba

Powering payments and banking for businesses

Formerly known as Kudi, Nomba provides payment infrastructure and business banking tools for small and medium-sized enterprises. The company enables businesses to accept digital payments, manage transactions, and access financial services tailored to local needs.

Nomba has raised tens of millions of dollars from global investors and is widely regarded as a key player in Nigeria’s fintech infrastructure layer. Its YC affiliation helped strengthen its early growth and investor confidence.

By supporting merchants and businesses, Nomba contributes to the broader digitisation of commerce across Nigeria and other African markets.

Helium Health

Digitising healthcare systems across Africa

Helium Health is a healthtech company focused on improving healthcare delivery through digital tools. Its platform helps hospitals and clinics manage electronic medical records, billing, telemedicine, and operational workflows.

In many African healthcare facilities, paper records remain the norm, leading to inefficiencies and errors. Helium Health addresses this by bringing modern health information systems to hospitals across Nigeria and other regions.

Backed by Y Combinator and other global investors, Helium Health has raised tens of millions of dollars and continues to expand its footprint. The company’s work highlights the role of technology in improving access, efficiency, and quality of healthcare in emerging markets.

Chowdeck

Building a local first food delivery platform

Chowdeck is a technology company focused on consumer logistics.

Unlike global delivery platforms that often struggle with local logistics, Chowdeck is built specifically for the realities of Nigerian, and similar cities.

The company optimises delivery routes, works closely with vendors, especially those in the food business, and adapts its operations to local infrastructure challenges. With YC backing and significant venture funding, Chowdeck has become one of Nigeria’s fastest-growing food delivery startups.

Its success reinforces an important lesson. Startups that deeply understand local markets can outperform generic global solutions.

Flutterwave

Powering payments across Africa

Flutterwave is unarguably Nigeria’s most well-known YC-backed startup. Founded to simplify payments across Africa, the company enables businesses to accept payments from customers anywhere in the world.

What makes Flutterwave stand out is scale. It supports multiple currencies, payment methods, and countries, making cross-border commerce easier for African businesses. Today, Flutterwave powers payments for thousands of companies, from small startups to global brands.

Its YC backing helped it gain early credibility and access to networks that accelerated its growth beyond Nigeria.

The bigger picture: What these startups represent for Africa

These companies share more than Y Combinator backing. They represent a shift in how African startups are perceived and valued globally.

Y Combinator provides more than capital. It offers mentorship, access to global networks, and credibility that opens doors to future investment. For Nigerian founders, this support has helped transform local ideas into globally competitive companies.

More importantly, these startups show that African innovation is not limited to niche solutions. Nigerian founders are building infrastructure, financial systems, healthcare platforms, and consumer products that operate at scale.

Closing

The rise of Nigerian startups backed by Y Combinator is not a coincidence. It is the result of resilient founders, real market needs, and increasing global recognition of Africa’s potential.

From agriculture and healthcare to fintech and logistics, these companies are redefining what it means to build technology from Africa. As more Nigerian founders enter global accelerators and attract international capital, the ecosystem will continue to mature.

This is no longer a story about potential. It is a story about execution, scale, and impact.

And it is only getting started.

Share this article

Related Articles

9 Nigerian Startups That Gained Funding in 2025

The top Nigerian startups that got millions of dollars in funding in 2025

Joseph Chisom

1 month ago

How Blockroll is Transforming Remote Earning

Meet Blockroll, the Nigerian startup redefining global payments, empowering independent workers to get paid globally and spend locally, powered by stablecoins.

Joseph Chisom

3 months ago

Meet Nigeria's Foremost WellTech Startup: HappiVibe

How HappiVibe is transforming Nigeria's mental health space as the nation's first WellTech startup, one call at a time.

Wisdom Usa

3 months ago